If you’ve been watching interest rates, you’ve probably noticed they’ve started to settle down and that’s reshaping the Calgary real estate market in a big way. With the next Bank of Canada announcement coming up on October 29, 2025, here’s what’s happening now, where rates are trending, and what to expect if you're buying or selling this fall.

Are Today’s Mortgage Rates Good?

It depends on what you compare them to.

If you look back to the peak of 2023 and 2024, when many mortgages were priced above 5%, today’s rates look much better. Seeing rates closer to the mid 4% range again means lower monthly payments and more flexibility for borrowers.

If you compare them to the pandemic years when interest rates dipped under 2%, they don’t look as appealing. But those extremely low rates were temporary emergency measures and aren’t expected to return.

Over a longer timeline, today’s rates are actually fairly normal. For most of the last two decades, mortgage rates in the 4 to 5% range have been the standard.

What That Means For Calgary Homebuyers Today

Calgary’s current benchmark home price is about $721,432. With a 20% down payment, the mortgage works out to roughly $577,146.

Here’s how the monthly payment shifts at different interest rates on a standard 25-year amortization:

At 5%, the monthly payment is about $3,357.

At 4%, the payment drops to around $3,036.

At 3%, it falls to approximately $2,732.

The difference between 5% and 4% interest is roughly $321 per month, or about $3,850 per year, which adds up to nearly $19,250 over five years. Even 1% makes a meaningful impact on affordability.

How Rates Are Shaping the Calgary Market

The higher rates of the past two years cooled the frenzy we saw during the pandemic. That means buyers now have more breathing room.

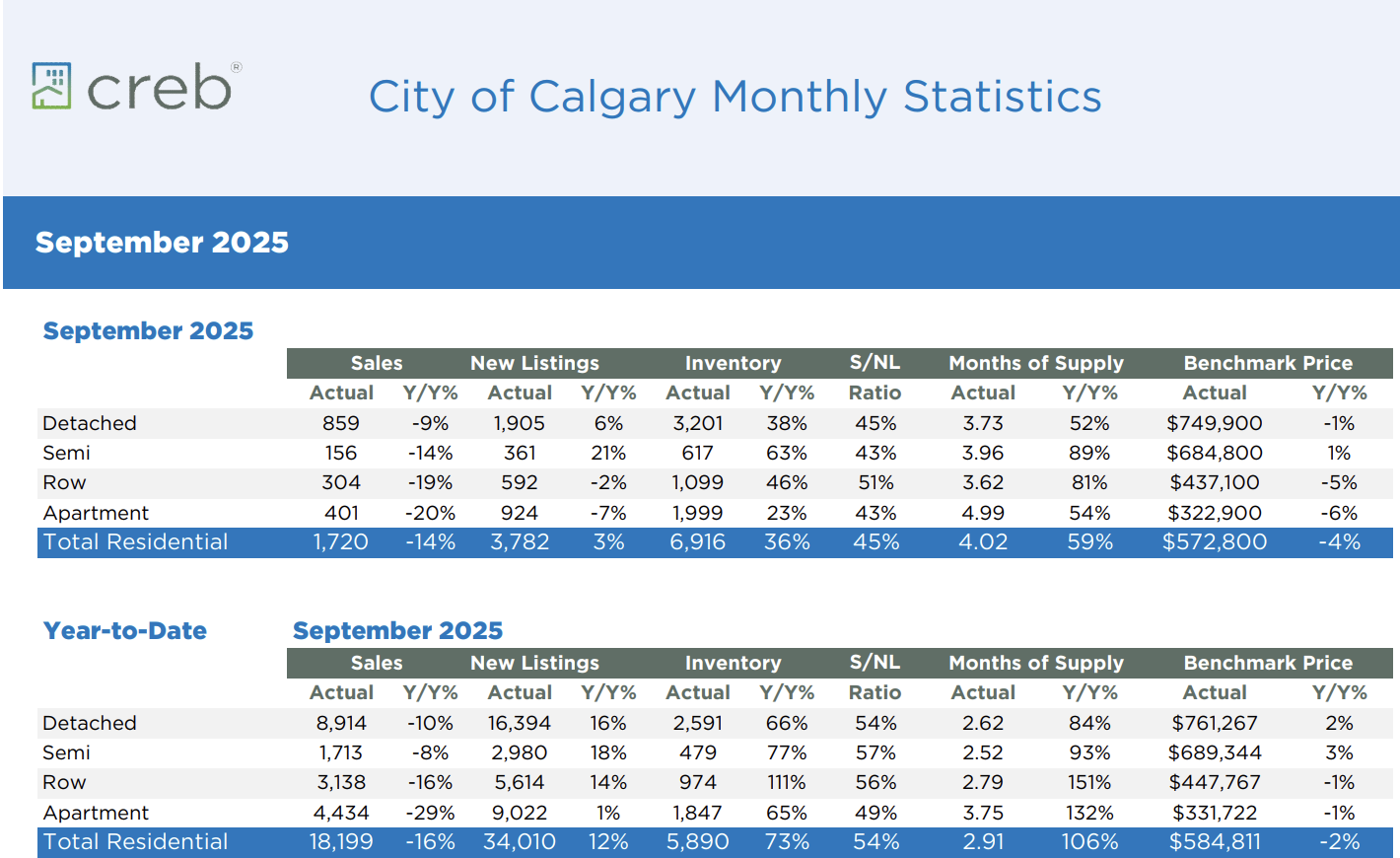

Inventory has increased from roughly 5,800 listings last year to more than 6,800 today. Detached home sales are down about 10 percent year over year, and homes are taking longer to sell. Buyers have more time to view properties, include conditions like home inspections, and negotiate.

For sellers, pricing strategy matters again. Homes that are priced realistically are still selling at a reasonable pace, while overpriced homes are sitting. Some property types are holding up better than others. Semi-detached homes remain relatively stable. Condos and apartments have taken the largest hit in this market.

What to Watch on October 29

The Bank of Canada’s overnight rate is currently 2.50%. Many economists expect that number to gradually move down toward 2.25% by the end of 2025. There is a reasonable chance that we see a small quarter-point cut at the October 29 announcement, but there is also a meaningful possibility that the Bank holds steady to wait for more inflation data.

A cut would make variable mortgage rates slightly more affordable and may encourage more buyer activity. If the Bank holds the rate, we may see the current balanced conditions continue a little longer.

What This Means for You

If you are buying, even a small rate drop improves affordability, but the real advantage right now is the breathing room in the market. You can take your time, evaluate options, and negotiate.

If you are selling, pricing and presentation are now just as important as the property itself. The market is still moving, but buyers are more selective than they were two years ago.

Conclusion

We are transitioning still toward a more stable and predictable market. Rates are easing slowly, not dramatically, and that supports sustainable home prices rather than sudden swings. It is a much more healthier environment for both buyers and sellers than what we saw during the extremes of the last few years.

If you are thinking about making a move, planning based on current trends and your timeline will matter more than trying to time the market perfectly.