The Calgary real estate market is always shifting, and this fall is no exception. The Bank of Canada dropped the policy rate to 2.50% on Sept 17, but the market isn’t exactly taking off just yet. While rate cuts usually light a fire under buyers, this month’s numbers show a market that’s still finding its balance.

Let’s take a look at what the stats are telling us and why this might be the perfect window buyers have been waiting for.

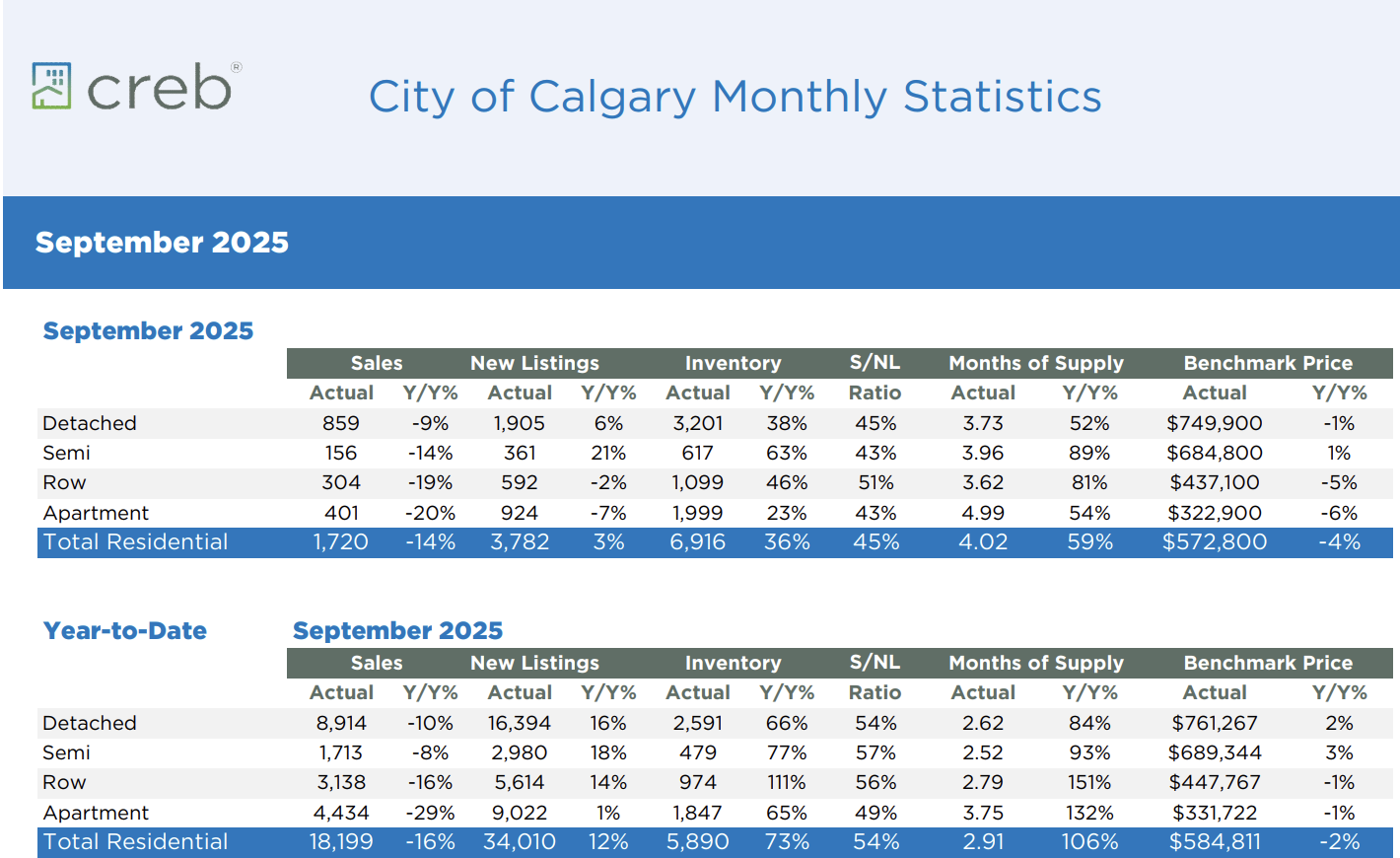

September Report:

Benchmark price: $572,800 ⬇️ 4.0% year-over-year

Sales: 1,720 homes ⬇️ 14.0%

New listings: 3,782 ⬆️ 2.6%

Inventory: 6,916 homes ⬆️ 36.5%

Months of supply: 4.02 ⬆️ 58.7%

Days on market: 42 days (up from 28 last year)

In short: buyers are taking their time, sellers are adjusting, and inventory is finally giving people some real choice again.

CREB’s Chief Economist, Ann-Marie Lurie, notes that the surge in new listings across resale, new home, and rental markets is giving buyers more options just as demand softens due to slower population growth and economic uncertainty. The result? Less urgency, more negotiation room, and modest price pullbacks across most property types.

The Bank of Canada Factor:

The 25-basis-point rate cut should’ve boosted activity, but it didn’t, at least not yet.

Here’s what’s happening:

Buyers are still cautious, even with better affordability.

Rate cuts alone aren’t enough to kick-start demand when confidence is shaky.

Economic uncertainty is keeping a lot of people in “wait and see” mode.

So yes, borrowing costs are down, but the mindset hasn’t caught up yet.

Buyers Finally Have Leverage:

With over 4 months of supply (the highest since 2020) and a sales-to-new-listings ratio of just 45%, the market has clearly shifted toward buyers.

If you’re buying right now, here’s what you get:

Over 7,000 homes to choose from

More time to think (45 days on market, on average)

Negotiating power

Freedom to include conditions without losing out

If you’re selling:

You’re competing with over 7,000 listings

Buyers expect flexibility

Pricing right from the start is more important than ever

Property Market Breakdowns:

Condos: This segment saw the sharpest shift.

Sales: 401 (down 20.1%)

New listings: 924

Sales-to-new-listings ratio: 43%

Inventory: 1,999 units

Benchmark price: $322,900 (down 6%)

With nearly five months of supply, the first time since 2021, the apartment market now leans solidly in favour of buyers, especially with more rental supply easing urgency for both first-time buyers and investors.

Townhomes: More stable but still cooling.

Sales: 304

New listings: 592

Inventory: 1,099

Benchmark price: $437,100 (down ~5%)

Inventory is at its highest September level since 2018. The North East district continues to see the largest softening here.

Detached: Still the market’s anchor.

Sales: 859

New listings: 1,905

Benchmark price: $749,900 (down 1%)

While new listings rose and the sales-to-new-listings ratio dropped to 45% (a level not seen since 2018), detached homes remain relatively balanced compared to condos and rows.

Semi-Detached: Surprisingly resilient this fall.

Sales: 156

New listings: 361

Benchmark price: $684,800 (up 1%)

Inventory has climbed, but prices have barely budged, up slightly year-over-year thanks to solid demand in the City Centre.

District Snapshot:

East: $409,000 ⬇️ 6.5%

North East: $485,000 ⬇️ 7.9%

North: $534,900 ⬇️ 6.0%

South East: $563,800 ⬇️ 3.2%

South: $569,100 ⬇️ 3.7%

City Centre: $576,800 ⬇️ 4.4%

North West: $633,200 ⬇️ 2.1%

West: $707,300 ⬇️ 2.3%

The most affordable areas (East and North East) continue to see the steepest price adjustments, while higher-end districts show more resilience.

Why This Buyer Window Won’t Last:

Right now, buyers have the most leverage they’ve had in years. But this balance won’t last forever.

Here’s why:

Rates could keep dropping, sparking demand again.

Calgary’s economy and migration trends are still strong.

Builders are facing delays, limiting future supply.

Once sentiment shifts, competition will pick up again and these price dips might disappear.

What to Watch Next:

The next Bank of Canada rate announcement

Employment and confidence trends

Whether inventory keeps rising or starts to level off

The typical winter slowdown leading into spring 2026

Conclusion:

September made one thing clear, Calgary’s market has officially tipped in favour of buyers. With prices down around 4% year-over-year and inventory climbing, there’s finally some breathing room for anyone looking to make a move.

If you’ve been sitting on the sidelines waiting for the right moment, this might just be it.

And whether you’re planning to buy while conditions are in your favour or looking to position your home competitively in a shifting market, having the right strategy and guidance will make all the difference.