If you’ve ever looked up home prices in Calgary and wondered why every site gives you a different number, you’re not alone.

One website says the average home price is $804,000, another shows a median price of $720,000, and the Calgary Real Estate Board (CREB) reports a benchmark price of $760,500.

So which one’s right?

Here’s the thing: they’re all right, but they’re telling you different stories about the same market. Understanding these differences can help you avoid costly mistakes when buying, selling, or investing in Calgary real estate.

Quick Guide to Home Price Metrics

Keep this cheat sheet handy the next time you’re browsing listings or checking a market report:

Benchmark Price → The “typical” home with standard features (best for tracking trends).

Median Price → The middle price when all sales are lined up (good for realistic budgets).

Average Price → All sales added up and divided (broad overview, but easily skewed by luxury homes).

When to use each:

Why These Numbers Matter:

Calgary’s housing market moves quickly. Prices change not just year-to-year, but season-to-season and even between neighbourhoods.

Using the wrong number is like using the wrong map, you could end up looking at homes way outside your budget or miss opportunities in your price range.

Buyers, sellers, realtors, and even policymakers rely on these metrics, but for different reasons. Let’s break them down.

Benchmark Price: The Most Reliable Metric:

Think of the benchmark price as the cost of a “standard” Calgary home.

CREB calculates it using the MLS® Home Price Index (HPI), which looks at homes with similar features: bedrooms, square footage, lot size, neighbourhood, and age, and tracks how much that “typical” home would cost today.

Why it works: It filters out extremes like $3M luxury estates or teardown properties.

Example: In February 2025, Calgary’s detached home benchmark price was $760,500, up 5.08% from the year before. That’s a solid indicator of where the overall market is heading.

Best used for: Understanding market trends over time.

Median Price: The Middle Ground:

The median price is the easiest to picture. Line up every home sale from cheapest to most expensive—the middle one is the median.

Why it matters: It avoids being skewed by a handful of luxury sales.

Example: In February 2025, the median price of detached homes was $720,000, while the average was $804,439. That’s an $84,000 gap, showing how expensive sales pulled the average up.

Best used for: Setting a realistic budget when house hunting.

Average Price: The Simplest (But Trickiest):

The average price is exactly what it sounds like, add up all sales and divide by the number of sales.

The problem? A few million-dollar sales can drag the number way up, even if most homes sold for much less.

Example: In February 2025, Calgary’s detached average was $804,439, but half the homes actually sold for less than $720,000 (the median).

Best used for: Big-picture overviews and total market value, but not personal budgeting.

Calgary Market Examples: February 2025

Here’s how these numbers looked across property types:

Detached Homes

Benchmark: $760,500 (+5.08% YoY)

Median: $720,000 (+1.41% YoY)

Average: $804,439 (+3.50% YoY)

Apartments/Condos

Benchmark: $334,200 (+3.95% YoY)

Median: $330,000 (+4.76% YoY)

Average: $353,334 (+6.33% YoY)

Semi-Detached Homes

Benchmark: $683,500 (+6.90% YoY)

Median: $640,000 (+7.56% YoY)

Average: $719,393 (+7.92% YoY)

Notice how detached and semi-detached homes show bigger gaps between median and average (luxury sales skew the numbers), while condos are more consistent.

What This Means for You:

For Buyers: Don’t set your budget by the average price. Look at the median for a realistic sense of affordability, and use the benchmark to see whether prices are trending up or down.

For Sellers: Benchmark pricing helps you position your home. If your property has upgrades or extra features, price above the benchmark. If it needs work, you may need to price below it.

For Investors: Pay attention to all three. A rising benchmark signals market strength, while shifts between median and average can highlight which segments (luxury vs. mid-range) are driving sales.

Where to Find These Numbers

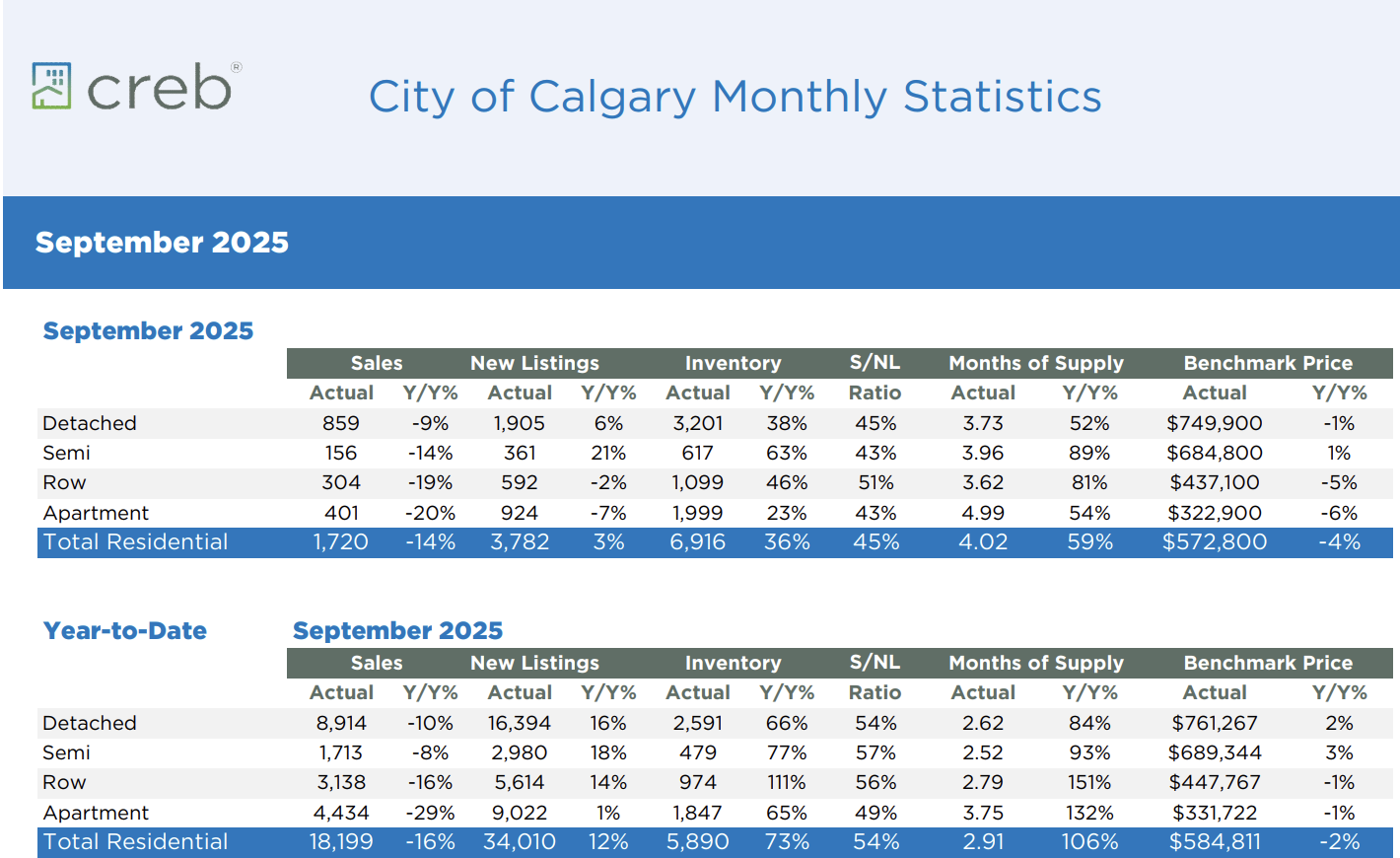

CREB - Monthly market reports, neighbourhood breakdowns, and historical data.

CREA - National comparisons and forecasts.

Realtors - Access to MLS® sales data and context for what these numbers mean for your situation.

City/Province - Housing data, economic trends, and development plans.

Conclusion:

No single number tells the whole story. The smartest buyers, sellers, and investors use all three metrics together:

When benchmark and median rise but the average is flat, it suggests luxury sales are slowing while the general market stays strong. If the average rises much faster than the median, luxury homes may be driving the surge.

Numbers are powerful, but only when you know how to read them.

If you’re ready to dig into what these trends mean for your goals in Calgary’s market, reach out to a local real estate professional who can put the data into context and help you make the smartest move.